Recently, the Singaporean government implemented a new round of surprise “cooling measures” in its housing market, including an eyebrow-raising 60% tax rate for foreign property investors and buyers.

This marks a doubling of stamp duties in a market where the costs of purchasing a private property is now the highest in the Asia-Pacific region, overtaking Hong Kong with an increase of 8% in median price over the past year.

ALSO READ: Is Buying Freehold Property In Malaysia Still Worthwhile?

This has sparked much talk about its impact on the Asean property market, which has seen increasingly stronger interest in the last few years due to political stability and steady economic growth.

According to Asian property technology group Juwai IQI, the cooling measures are pushing more high-end property investors towards the Malaysian market, estimating that foreign property purchases in Malaysia will increase by 15% in the next 12 months, in addition to the expected growth.

Most of these buyers will be looking for properties valued at RM2 mil or higher.

Current property tax rates in Singapore following the announcement of ‘cooling measures’

CEO and co-founder of Juwai IQI, Kashif Ansari, observed that while this does not mean a dramatic surge in foreign buyers for Malaysia, there is definitely a positive spillover effect especially with Malaysia’s proximity to Singapore.

“Malaysia has vast land area and multiple metropolitan property markets, each comparable in size to Singapore’s entire domestic market. Because of its larger and more diverse market, it can easily accommodate any number of foreign buyers,” Kashif said.

Property tours to Malaysia have been picking up again post Covid-19 pandemic. In a special feature by Nanyang Siang Pau, it was reported that interest from Chinese investors is expected to grow in the second and third quarters of 2023.

In fact, for KSK Land, the property developer of 8 Conlay – an integrated development project in the heart of Kuala Lumpur that will house branded residence twin towers YOO8 serviced by Kempinski – their representatives told Nanyang that there has been an almost immediate surge in Chinese property tours and interest since early this year.

Artist’s illustration of the lobby at YOO8

While most overseas property investors tend to look towards the cities of Johor, Kuala Lumpur and Selangor, industry experts are observing a stronger focus on prime locations here in the heart of Malaysia’s capital city.

This has been a growing trend, perhaps further encouraged by the pandemic. In a survey done among nearly 350 real estate agents by Juwai IQI in 2022, it was observed that Singaporeans now generally prefer to own property in areas such as Kuala Lumpur City Centre, compared to a stronger interest in Johor years ago.

“Consider what a Singaporean could purchase with S$700,000 to S$800,000 (RM2.3 million to RM2.6 million) in an exclusive area such as Orchard Road and the surrounding roads, versus what that money can buy around the Pavilion area in Kuala Lumpur,” the Yahoo news report quoted.

Apart from a much more competitive tax rate, there are a few other reasons that make Kuala Lumpur an attractive market for foreign property investors:

Kuala Lumpur City Centre has become the popular choice for foreign property investors over the last few years

1. Affordable Property Prices

According to global property consultancy Knight Frank, Malaysia offers competitive property prices, making it an appealing investment destination and indicates a potential for attractive returns on investment as property values appreciate over time. In 2020, it was reported that compared to Singapore’s average housing costs of US$1,700 psf, the Malaysian average is about US$143.33 (about RM650).

2. Foreign Ownership Policies

Malaysia allows for foreign property investors to own properties in Malaysia. On top of that, government initiatives such as Malaysia My Second Home (MM2H) and the Premium Visa Program (PVIP) further enables overseas buyers to make Malaysia a second home. The MM2H in particular had successfully drawn in many overseas property investors until recently, where it was largely affected by the pandemic. The current government is now reviewing the terms in order to make property investment in Malaysia more appealing once more.

3. Lower Taxes and Ease of Selling

According to Deloitte’s Taxation and Investment in Malaysia 2022 guide, Malaysia imposes relatively favorable tax rates on property transactions, including no more than 30% capital gains tax for properties of over RM2 mil, and up to 4% stamp duty only. These lower taxes enhance the overall investment returns. Furthermore, Malaysia’s well-established and efficient property transaction process ensures ease of selling both for local and foreign buyers.

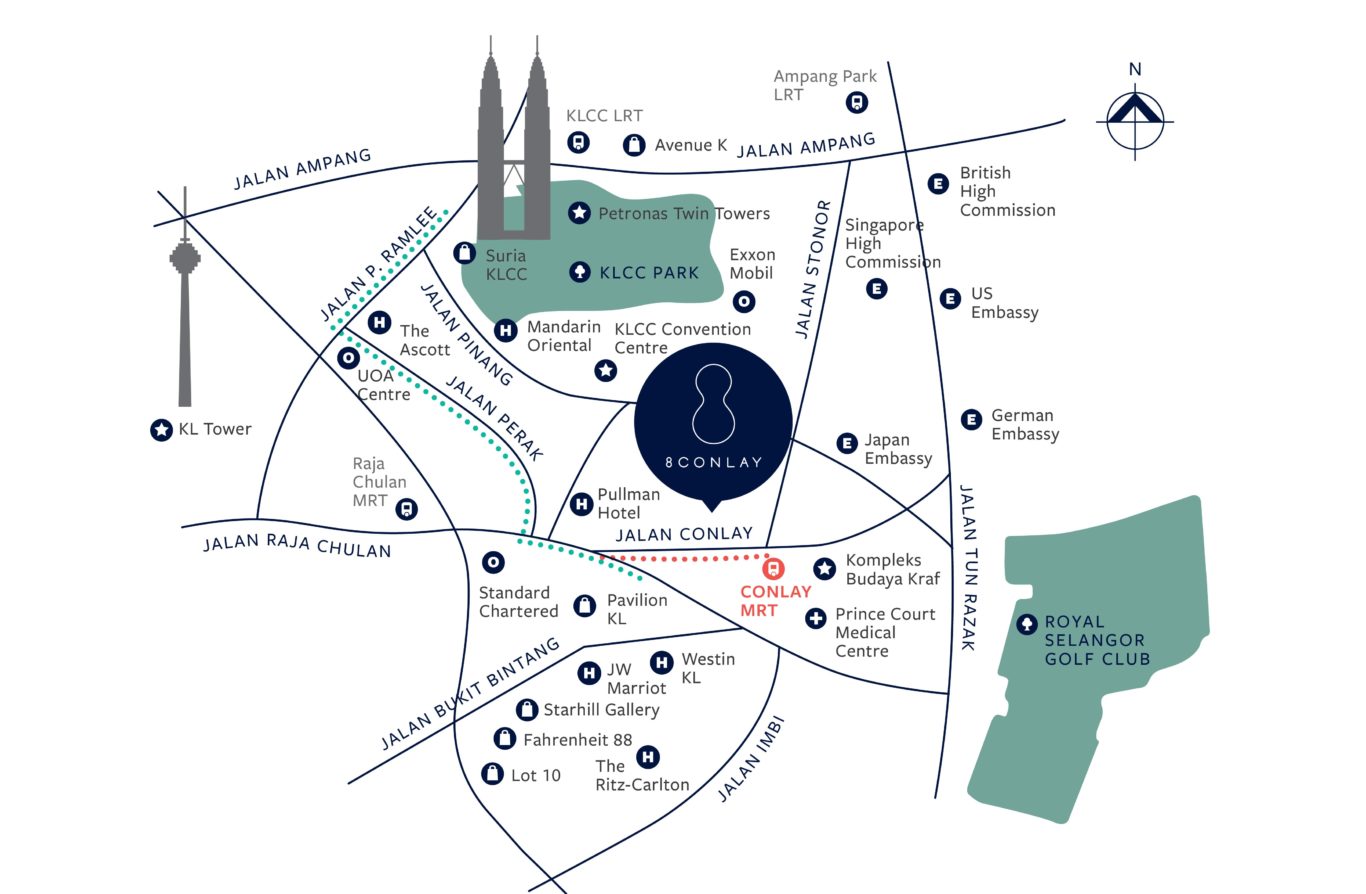

A map of 8 Conlay’s surrounding neighbourhood and offerings

4. Strategic Location and Connectivity

Experts at Juwai IQI highlighted that Malaysia’s strategic location in Southeast Asia is attractive to property investors. They noted that Malaysia’s proximity to neighboring countries, including Singapore, Thailand, and Indonesia offers opportunities for cross-border trade and business collaborations, boosting potential for investment as well as new economic opportunities. The 2022 real estate survey among 350 agents also pointed out that locations within the city with easy access to amenities such as offices, banks, dining and shopping options as well as international schools for families, are particularly attractive.

Located in the heart of Kuala Lumpur City Centre’s “Golden Triangle” a mere 400-metres away from the city’s famed shopping and lifestyle district of Bukit Bintang, 8 Conlay is also a short stroll away from the Conlay Mass Rapid Train station that connects the city; five-star hospital Prince Court Medical Centre; one of Southeast Asia’s oldest golf course, The Royal Selangor Golf Club; at least five international schools within a five-kilometres radius; and is a short distance away from Tun Razak Exchange financial district.

Be it design, services and amenities, 8 Conlay’s YOO8 – set to be the world’s tallest twisted twin residential towers – will offer those accustomed to quality living the best branded residence and luxury lifestyle in Kuala Lumpur. To find out more, contact us.